Volatility Rising is a Matter of Perspective

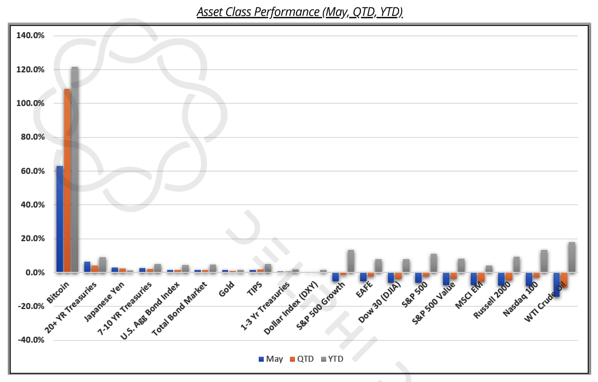

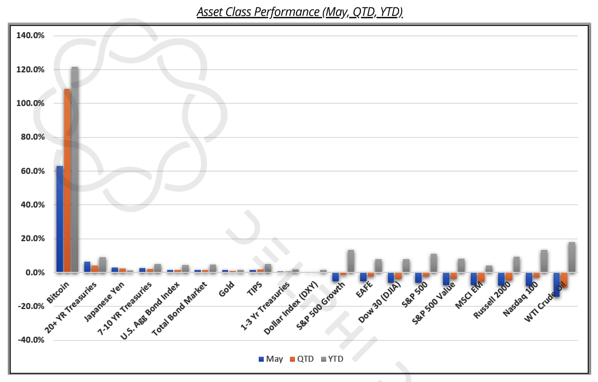

Bitcoin is now up over 100% YTD, as are most Digital Asset indexes. But investors know to look at risk-adjusted returns rather than nominal returns. Through May, the Sharpe Ratio for BTC is 3.20% YTD, compared to 0.66% for the S&P 500. Simple math tells you that if BTC is up over 10x compared to US stocks, but the Sharpe Ratio is up only 5x, volatility must be high .

This is of course true. The Bitmex Bitcoin Volatility Index (BVOL) has reached new YTD highs, and implied volatility is exceeding realized volatility by a healthy margin.

At the same time, here are some interesting stats:- Bitcoin and the overall crypto market have posted gains week-over-week for the past 7 weeks

- Bitcoin and the overall crypto market haven’t had a double-digit weekly decline since January 13th

- Bitcoin hasn’t fallen more than 3% week-over-week since January 13th

- In 16 out of the past 22 weeks, returns have been positive

For traders, crypto has been very volatile. In fact this past week alone, in one single trading day (Thursday), Bitcoin rose from $8700 to $9000, then dropped below $8200, and ultimately finished the day at $8500. Traders witnessed a 10% intra-day move. Meanwhile, the net effect was a pedestrian 2% day-over-day decline.

Perspective matters.

Token Offerings are Getting Very Interesting

Another new crypto protocol is on its way. Algorand , like many before it, is purportedly solving problems of decentralization, scalability, security and speed, as each of the other 20+ past protocols have claimed.

Without opining on the merits of the Algorand deal itself (though we encourage you to listen to this week’s Base Layer podcast to learn more), we want to highlight the structure of the token offering. New ALGO tokens will be offered via a Dutch Auction process , instead of via the more traditional ICO or IEO process. This is an innovative offering technique for an asset that is notoriously difficult to value, as there is no easy way to anchor investors to a “fair value” price. It’s also a bull market maneuver, preying on high demand and low price elasticity. When Google IPO’d in 2004, using a similar Dutch Auction process in lieu of traditional capital markets underwriting, it was viewed as a risky maneuver that if successful might change the way securities are offered in the future. Alas, it was a success for Google, but did little to change the way securities were sold in the future, and didn’t make a dent in the hefty Wall Street fee structure. But it did allow consumers to set the price rather than underwriters, and allowed those who care about Google the most to participate rather than just those with the biggest wallets and greatest access to Wall Street brokers. Similarly, Algorand believes this is the best way to fairly disseminate tokens to the most interested future users and investors.

Perhaps more interestingly, unlike equities and bonds that have explicit hard caps or at least implicit caps in the form of market cap and reasonable use of proceeds, token issuances have no ceiling. As a result, it’s plausible and highly probably that Algorand will end up raising WAY more than they need to finish this project. As such, Algorand is offering to buyback tokens at 90% of the issue price (if the clearing price is $1 or greater) OR $0.10 below issue price (if below $1) exactly 1 year after issuance. Effectively, buyers of ALGOs have a 1-year put option, but the value of that put option is based on the clearing price.

This introduces some interesting game theory dynamics. If you want to own the put, you have to participate in the auction. But some OTC dealers have been offering rights to an ALGO SAFTs token right issued via SAFTs are already outstanding from their initial raise last year, and these tokens do not carry these same put rights. But, you can buy the new ALGOs, sell them immediately, and retain the put for 1 year (the put doesn’t travel to the new buyer in a secondary sale). This may end up looking similar to credit default swaps, where the notion of “cheapest to deliver” comes into play (i.e. if ALGO trades down, those that hold tokens without a put may be able to push the token price higher as they know there will always be a bid from those who still own the put).

This introduces some interesting game theory dynamics. If you want to own the put, you have to participate in the auction. But some OTC dealers have been offering rights to an ALGO SAFTs token right issued via SAFTs are already outstanding from their initial raise last year, and these tokens do not carry these same put rights. But, you can buy the new ALGOs, sell them immediately, and retain the put for 1 year (the put doesn’t travel to the new buyer in a secondary sale). This may end up looking similar to credit default swaps, where the notion of “cheapest to deliver” comes into play (i.e. if ALGO trades down, those that hold tokens without a put may be able to push the token price higher as they know there will always be a bid from those who still own the put).

Regardless of how this plays out, this is yet another innovative financing option available in the token world, and is part of the reason so many investors are flocking to this space. Creative financing structures, and flexible tokenomics, are a blessing for both issuers and investors.

Notable Movers and Shakers

For those less tapped in to the happenings of the digital asset space, this past week may have looked uneventful - Bitcoin finished the week flat. However, there were two defining aspects of last week: Bitcoin’s volatility on Thursday, and the continuation of altcoin differentiation.

- EOS (EOS) hit the presses hard last week: Block.One announced their social media product “Voice”, Coinbase Earn added EOS to their education program that pays users in EOS to learn about the project, and EOS stakeholders voted to reduce the inflation fee by 80%. What does this translate to? A weekly peak of +24% right up until the June 1st announcement, with the project settling at +10%. Many were left disappointed, with hopes that the large war chest Block.One possesses would be put to use for a more vital product. Nevertheless, products are still being built - this is a step forward, not backwards.

- Monacoin (MONA) had an impressive week (+155%) that left many scratching their heads - what is Monacoin? The best comparison we can draw from is that it is the Japanese equivalent of Dogecoin - a community created coin in the early days of the space - to many it has no use, but the fervent community keeps the project alive. Last week’s move can be attributed to rumors that MONA was listing on CoinCheck - one small step for MONA, one giant step for the Japanese community.

- Projects like Cosmos (ATOM) and Ravencoin (RVN) each saw impressive weekly gains (+40%,+36%), with no evident news to boot. The main correlation that can be drawn here is that both projects were created after the infamous 2017 bull run. By missing the brunt of the bear market, each project has been afforded a “Tabula Rasa” - a clean slate to prove their worth regardless of market sentiment. It will be interesting to see how other projects born in the bear market fare in the coming weeks/months, as market sentiment continues to heat up.

What We’re Reading this Week

Those that find it challenging to purchase Bitcoin online may now only need to walk into their local grocery store to buy some BTC. After a large amount of consumer demand, Coinstar is now offering the ability to purchase BTC at 2,200 locations throughout the U.S. The technology for these kiosks is powered by Coinme, the first state-licensed Bitcoin ATM provider. Access to digital assets is one of the hurdles to widespread adoption and usage, and Coinstar is making it easier for everyday consumers to get their hands on crypto. You can check out if there’s a BTC ATM near you on CoinATM Radar .

Proof of Capital, a blockchain VC firm, released this report covering the remittance market and new technology firms that may usurp current incumbents. Remittances accounted for $550b with an average transaction of just $200; individuals are charged 6.94% in fees totaling $48b a year. The amount of remittances has been steadily growing as the number of migrants has outpaced population growth, leading to increased fees. With billions of dollars transacted through these systems per year, will users still pay such high fees for inefficient services? If solved correctly, the market for frictionless payments goes far beyond remittances with the potential to capture the entire global payments market.

Salesforce announced last week that it has rolled out a blockchain platform offering a plug-and-play solution for its clients to establish their own blockchain ledger. The goal of the initiative is to allow institutions better data sharing with their customers. Among its first client to adopt the technology is Arizona State University who will use the ledger technology to track and share student records. Although many crypto enthusiasts are against private blockchains such as Salesforce’s, the benefits to institutions are obvious for decreasing back-office functions and increasing customer trust. The full blockchain offering will be widely available in 2020.

Last week Yahoo Japan launched Taotao, its crypto trading platform, previously known as BitARG which they acquired last year for a purported $19m. Taotao, which is branded under the Yahoo Japan umbrella, has been approved for a crypto exchange license by the FSA. As a crypto-friendly jurisdiction, Japan is the perfect market for Yahoo to launch its exchange in, additionally, the Yahoo Japan brand will bring new investors into the ecosystem.

Ernst & Young’s blockchain product, which runs on Ethereum, is being used to authenticate wines imported from Europe to Asia. The e-commerce platform will be used by hotels, restaurants, cafes and consumers. In addition to tracking authenticity, the platform is also used for logistics and payments. We’ll drink to that!

No comments:

Post a Comment